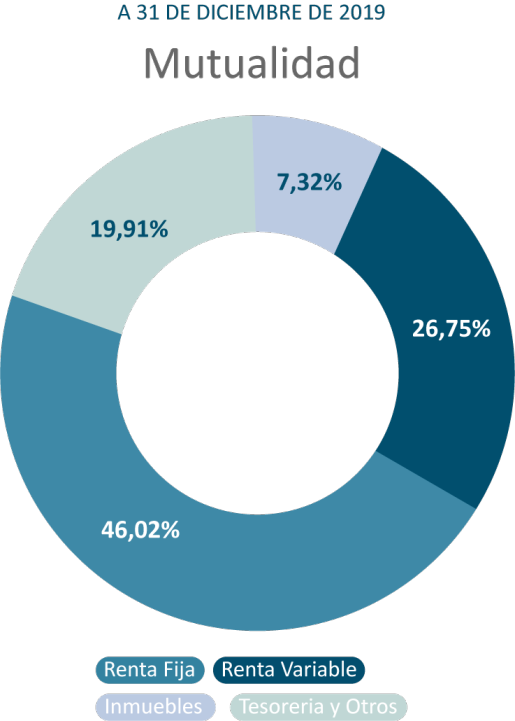

DATOS A 31 DIC 2019

Principales magnitudes 2019

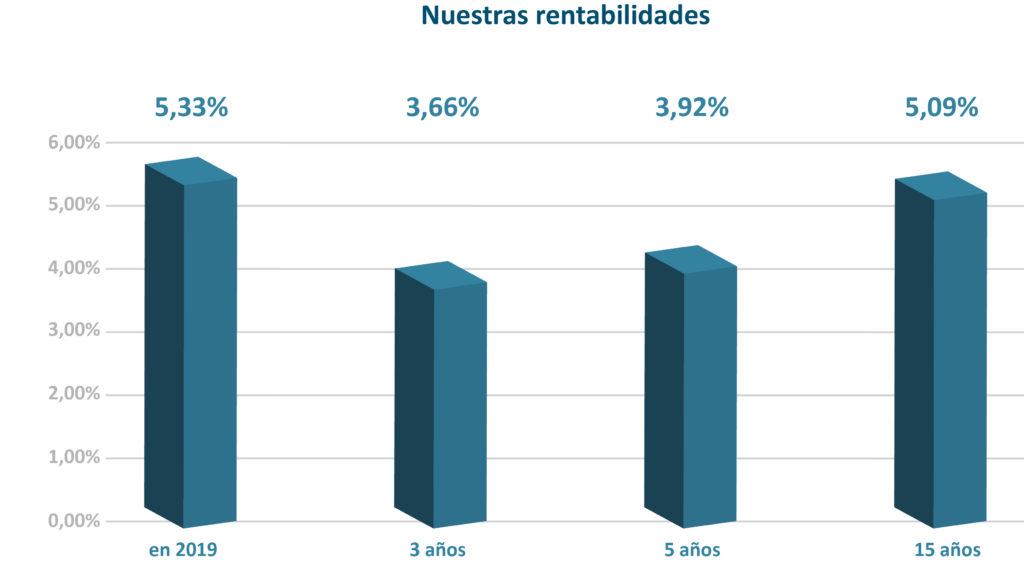

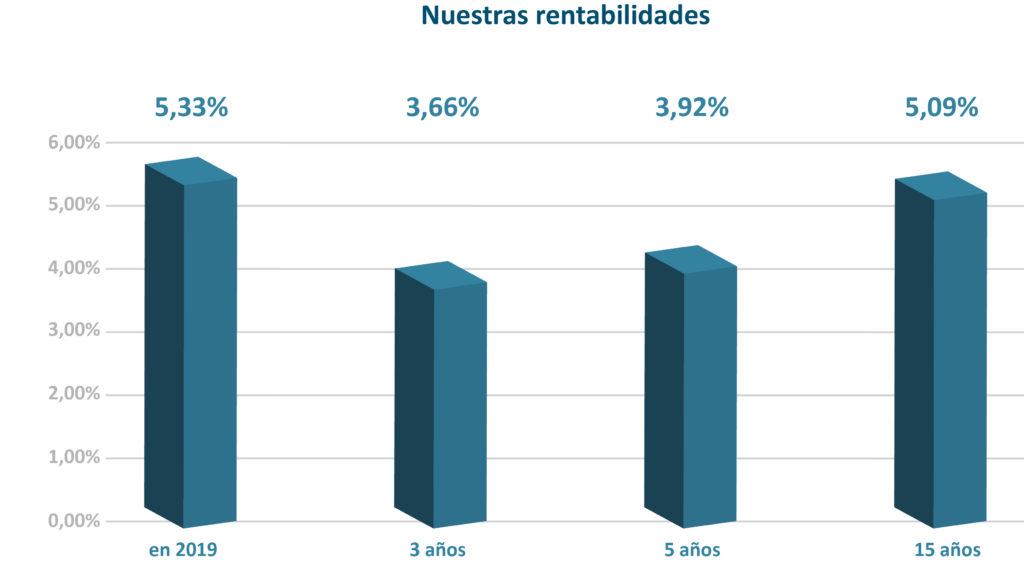

Rentabilidad 5,33%

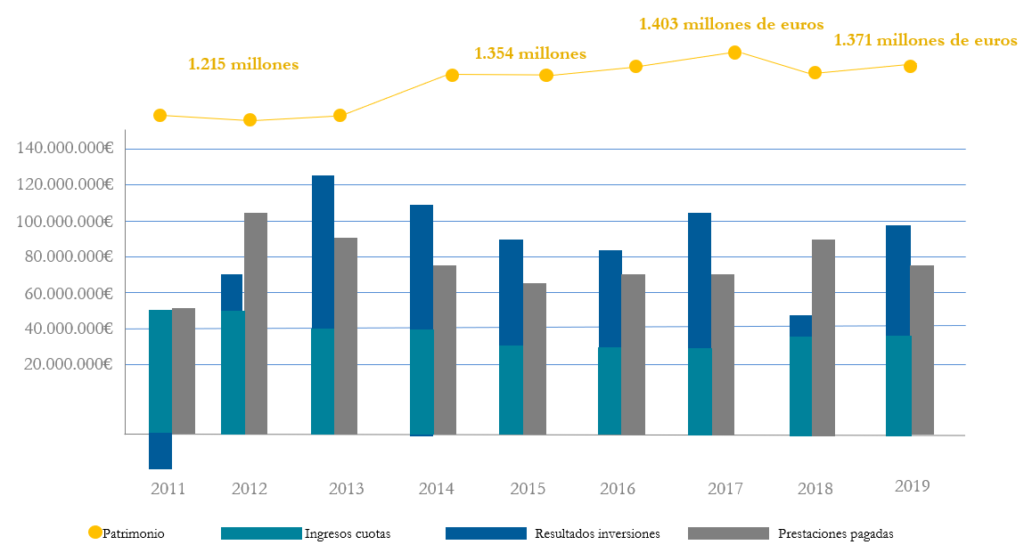

Resultados de las inversiones más de 59 millones de euros

Pagos a pensionistas más de 75 millones de euros

Producto de ahorro a largo plazo complementario a la pensión pública de la Seguridad Social dirigido a trabajadores del sector aéreo español. La Mutualidad, entidad sin ánimo de lucro, está formada en la actualidad por más de 24.500 profesionales, de compañías líderes como Iberia, Lufthansa, SAS, Groundforce, Easyjet, Air France, o KLM. Llevamos más de 40 años gestionando productos financieros de ahorro para la jubilación. Un periodo en el que hemos tramitado más de 1.300 millones de euros en prestaciones (principalmente jubilación, incapacidad, fallecimiento).

Por un lado, nos dirigimos a aquellas personas activas en este sector que tienen como objetivo mantener su nivel de vida tras su jubilación. Por otro, a compañías del sector aéreo preocupadas e interesadas en participar activamente en el patrimonio futuro de sus empleados.

Nuestra Mutualidad ofrece a ambas partes participar en uno de los mayores patrimonios gestionados a largo plazo para pensiones de nuestro país, con un patrimonio superior a los 1.300 millones de euros.

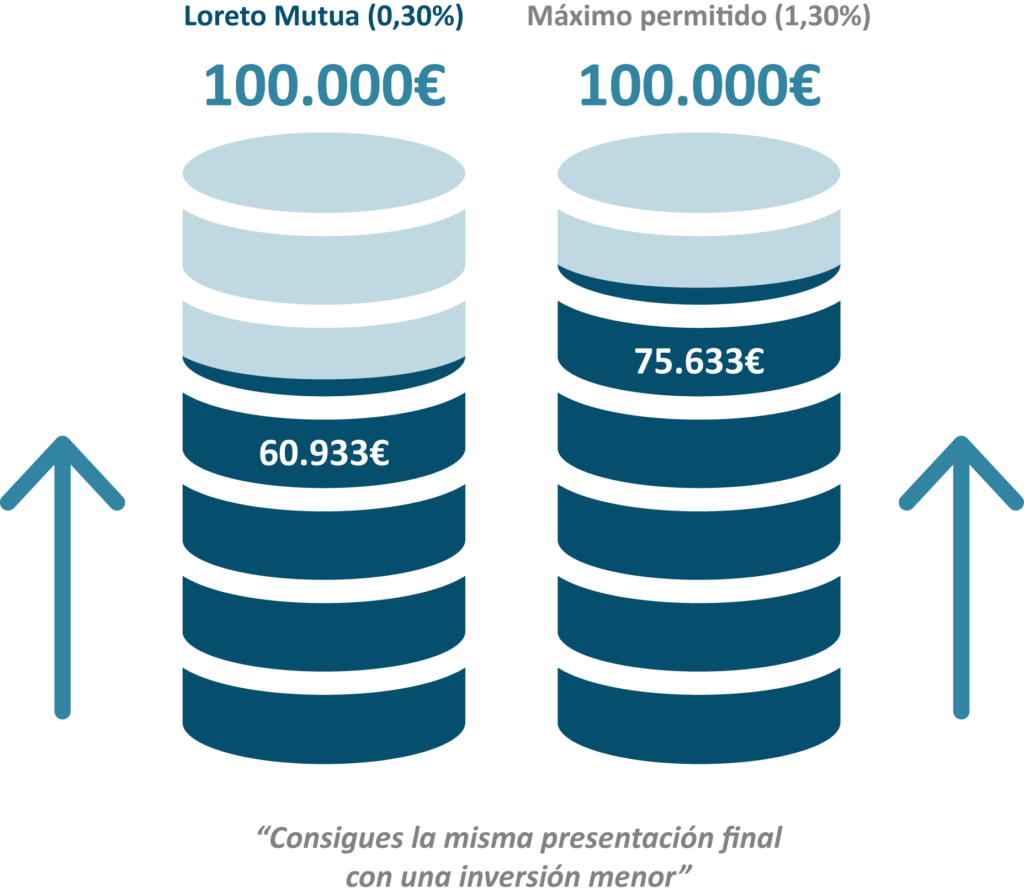

Nuestros gastos de gestión son hasta 4 veces más bajos que los que asumirías al contratar un plan de pensiones individual en una entidad bancaria.

Realizamos una gestión eficaz y prudente para proteger tu patrimonio a largo plazo.

Conocemos las necesidades de los trabajadores del sector aéreo, y nuestros 48 años de experiencia han sido dedicados en exclusiva a la gestión del ahorro para la jubilación.

Nuestros gastos de gestión son hasta 4 veces más bajos que los que asumirías al contratar un plan de pensiones individual en una entidad bancaria.

Al no estar vinculados a ningún grupo financiero, nuestras inversiones se alejan de especulaciones y otros intereses.

Podrás reducir de la base imponible en tu declaración del IRPF tanto tus aportaciones, como las efectuadas por tu compañía en el caso de que forme parte de su convenio.

Rentabilidad 5,33%

Resultados de las inversiones más de 59 millones de euros

Pagos a pensionistas más de 75 millones de euros

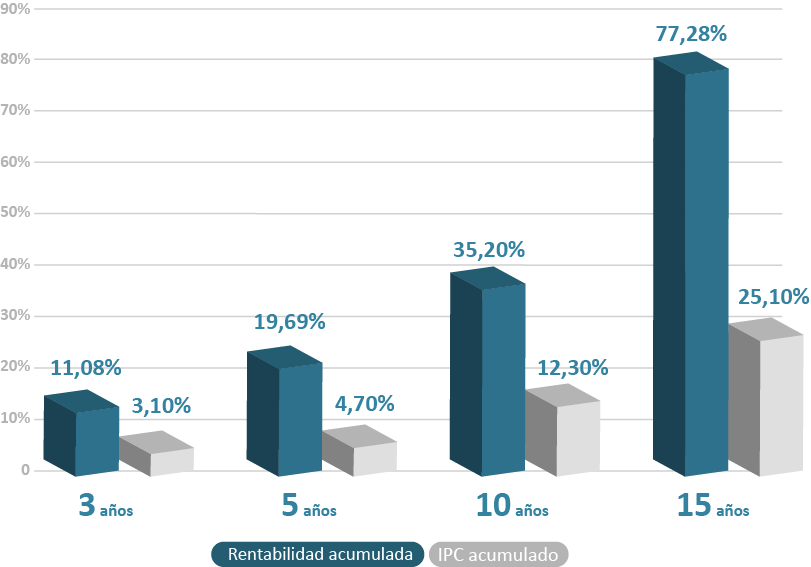

En la Mutualidad, además de ahorrar para completar tu jubilación, verás como el valor de tu capital obtiene rentabilidades muy superiores al valor de coste de vida.

Comparamos aquí el impacto de los gastos de gestión de nuestra Mutualidad (0,30%) con el de un plan que aplicará el máximo permitido (1,30%). Como muestra este gráfico, para conseguir ahorrar un capital de 100.000€ en 35 años a una rentabilidad media anual del 5%, el esfuerzo de ahorro de un mutualista de Loreto Mutua ascendería tan solo a 60.933€, un 30% menos que el capital a invertir a través de un plan individual con el gasto de gestión máximo.